Making Sensemaking of Equities: In What Ways Equity Research Professionals May Help

Engaging in stock market investments can often feel like navigating a complicated labyrinth filled with uncertainties and challenges. For both newbie and experienced investors, comprehending the complexities of the market is essential for making well-informed choices. This is where equity research professionals become essential, offering valuable insights and expertise that aids in shaping investment approaches. Their role is to decipher financial data, assess market trends, and give advice that could substantially affect the likelihood of success of stock investments.

Equity analysis professionals hold the skills to examine a company's financial health, competitive position, and future growth prospects. By delving into various financial metrics and market factors, they help investors identify mispriced stocks, find concealed chances, and mitigate risks. Taking advantage of the knowledge of these experts can allow investors to take advantage of market movements and make sound investment choices that are in harmony with their financial objectives.

The Function of Equity Analysts

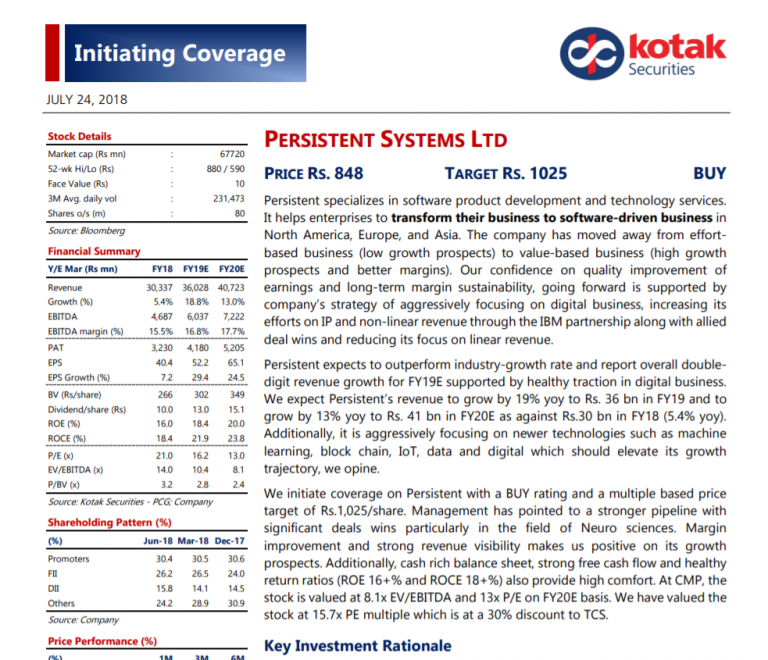

Equity analysts play a crucial role in the investment landscape by providing detailed research and insights that help stakeholders make sound decisions. They examine fiscal information, market trends, and economic conditions to evaluate the success of public companies. By examining financial statements, income statements, and cash flow projections, stock analysts assess the true worth of a stock, helping traders understand whether it is priced too low or overpriced.

These specialists utilize various financial models and valuation techniques to predict a company's upcoming results. Their reports often include suggestions on whether to buy, sell, or maintain a given stock, based on thorough analysis and data-driven conclusions. This guidance can be invaluable for retail investors and institutional clients alike, as it enables them to navigate the challenges of the stock market with more confidence.

Moreover, equity analysts contribute to the overall market efficiency by disseminating their conclusions through publications and lectures. This transparency helps to equalize access for all market participants, allowing them to access the same information and insights that institutional investors rely on. By utilizing the knowledge of equity analysts, traders can enhance their strategies and potentially increase their investment gains.

Essential Instruments and Techniques in Equity Evaluation

Stock analysts employ a range of methods and strategies to assess equities and provide investment recommendations. One of the primary instruments is financial modeling, which allows analysts to create detailed forecasts of a company's future performance based on historical data and projections about expansion rates. These models can help analysts estimate multiple financial metrics such as profits, liquidity, and worth using methods like discounted cash flow analysis. This holistic approach facilitates them to derive real values of equities and compare them with present market prices.

Another essential technique in equity analysis is the application of fundamental analysis. This involves examining a company's financial statements, such as the income statement, balance sheet, and cash flow statement, to judge its overall health and operational efficiency. Analysts often look at key financial ratios, including P/E ratios, ROE, and debt-to-equity ratios, to gauge worth in relation to peers and historical performance. By understanding these metrics, equity analysts can make informed decisions about whether a security is selling at a lower price than its worth or selling at a higher price than its worth.

Technical analysis is also a crucial component of equity analysis. This technique entails studying price charts and trading activity to identify patterns and trends that may indicate future price movements. Resources such as moving averages, support and resistance levels, and various indicators like the Relative Strength Index help analysts determine buy and sell points for transactions. While fundamental analysis focuses on the real value of a company, technical analysis augments this by providing perspectives into market sentiment and potential price movements, giving stock analysts a comprehensive view.

Decoding Equity Recommendations

Understanding analysts' advices is essential for making informed investment decisions. Equity analysts usually classify their recommendations into three main main types: purchase, hold, and dispose. A “buy” recommendation suggests that the analyst believes the stock will rise in value, suggesting a significant possibility for gain. In contrast, a “dispose” advisory implies that the analyst perceives the stock is too high in price or that it may drop, suggesting that shareholders should reduce their holdings. The “maintain” advisory typically signals that the analyst holds the stock will perform steadily, and there are no urgent reasons to acquire or dispose at that point.

Investors should not take these advices at face value but rather consider the reasoning behind them. Analysts generate thorough reports that include earnings projections, valuation metrics, and market patterns which are essential for understanding the context of their recommendations. By reviewing these reports, investors can gain insights into the company's financial health, the competitive landscape, and macroeconomic factors that might affect stock results. Understanding the rationale helps investors gauge if the recommendations align with their financial goals and risk tolerance.

It’s also crucial to note that analysts’ recommendations can vary widely depending on their expertise and viewpoint. equity research report may focus on short-term trends, while others maintain a sustained view. Investors should expand their sources of information and contrast various analysts’ views to create a more comprehensive view. By synthesizing various analyses, investors can more effectively assess stock worth and make calculated decisions fitted to their unique investment approach.